Created competitive analysis to assess competitors, determine firm strengths, and provide recommendations on how best to position the firm in the competitive and increasingly important mass affluent space.

Morgan Stanley is a global investment bank providing institutional advisory services

Created competitive analysis to assess competitors, determine firm strengths, and provide recommendations on how best to position the firm in the competitive and increasingly important mass affluent space. Project was reviewed and incorporated orated by the Managing Director of the Client Advisory Center (CAC).

Setting

Morgan Stanley is among the most prestigious investment banks in the world. For over 80 years, the firm has worked with individuals, families, businesses and institutions--delivering services and solutions that help build, preserve and manage assets.

Given more lucrative margins and resources that are typically only available to accredited investors, Morgan Stanley has always been uniquely positioned to serve the ultra-high-net-worth (UHNW) which usually consisted of individuals and families from older generations. This presented a unique problem for the firm (under the tutelage of Wealth Management) as the rising and growing demographic are millennials, but they had made little efforts to target them.

As a millennial myself, I sought to answer the following questions:

- What is the Millenial demographic as it pertains to the transfer of wealth and why is it significant?

- What drives Millenials in terms of personal finance?

- How best to target Millenials?

- What are their concerns over traditional financial institutions?

- How is Morgan Stanley positioned to cater accordingly?

- What is the strategy to be most effective?

User Research

I interviewed fellow colleagues, university friends, and acquaintances -- searching for a large and diverse enough of a sample size to deduct sound statistics. The criteria are as follows:

- Must be Millenials

- Different financial backgrounds (affluent, unemployed, with assigned trust-funds)

- Different educational backgrounds (high school, undergraduate completion, graduate completion, current student)

Here are additional points regarding Millenials:

- Current age 19 to 37

- Number about 79.8 million

- Getting married and having their first child later any previous generation

- Most ethnically diverse generation in US history

- Greatest number of college graduates ever; twice as many degrees conferred in 2009 as in 1970

- Highest amount in debt outstanding starting their careers; driven primarily by college loans

- Buying their first home later than in previous generations

- Came of age with the internet, mobile devices, and ubiquitous social media

The popular belief that Millennials are not interested in their personal finances is contrary to what surveys are indicating

Emergent Consumer Perspective

“Of all the generations surveyed, Millennials are the ones who most wish that they knew more about their finances. Millennials are not only hungry for financial knowledge but also drive interest in it. This reveals that the generation often viewed as not interested in finances is not only interested but wants help more than any other generation.“(1)

- 58% of Millennials feel that banks treat them like a number (highest among all age groups)

- More than 70% of Millennials say mobile banking is important to them(2)

- They want access to their finances as they do for every other part of their daily lives

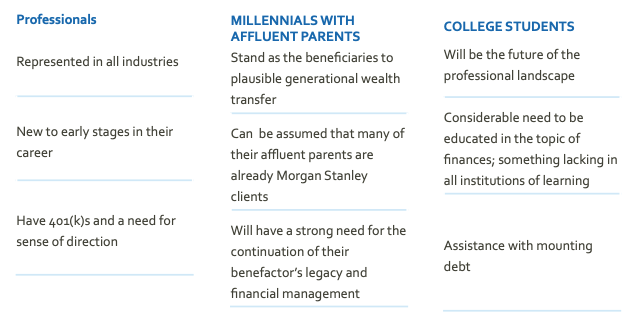

Target Demographics

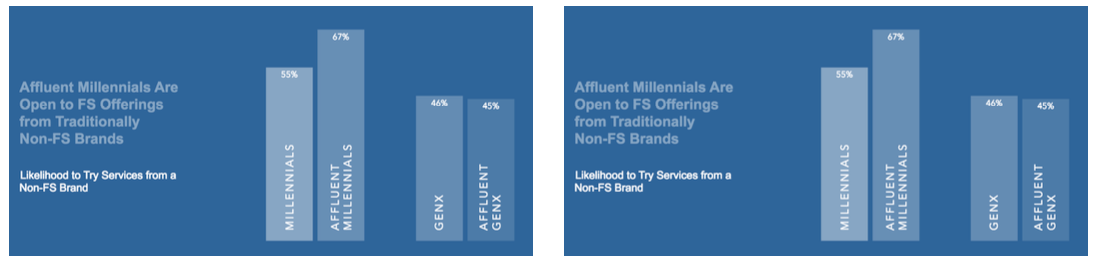

Millennials will actively peruse the internet and perform their own cost / benefit analysis in selecting their financial services provider

Key Findings:

- 48% of affluent Millennials are open to switching to another company better products and services(3)

- AgrowingnumberofMillennialsareturningtoalternativeservice providers who better offer the type of experience and relationship they are expecting with their respective firms

- Soloists

- Validators

Millennial Persona

Clients now expect immediate access to a myriad of service and insight - all while doing it at a low cost.

Threats to the existing Morgan Stanley CAC Model:

- AlternativeServiceProviders(e.g.Wealthfront, Betterment, Future Advisor, Personal Capital, Vanguard)

- Validatorsvs.Soloists(4)

- CurrentWealthManagementWirehouses(e.g. Merrill Lynch, Raymond James)

- Products specialists catering to consumers directly(e.g.FranklinTempleton, Vanguard, BlackRock)

Key Facts:

- 91% of affluent Millennials would use a social network to obtain opinions or commentary about financial topics, compared to only 53% of affluent Generation Xers.

- 81% of affluent Millennials would turn to a social network for reviews from current customers about financial products and services, compared to 44% of affluent Generation Xers • 80% of affluent Millennials would obtain information about retirement planning from their peers, as opposed to only 19% of Generation Xers

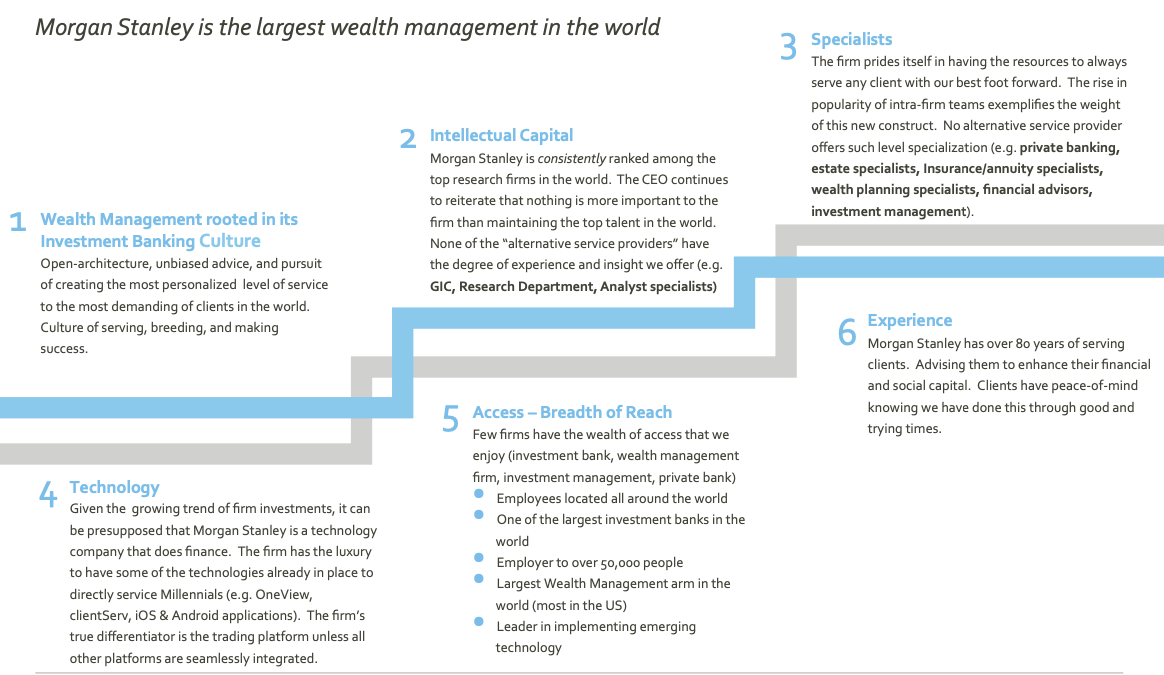

The Morgan Stanley Difference

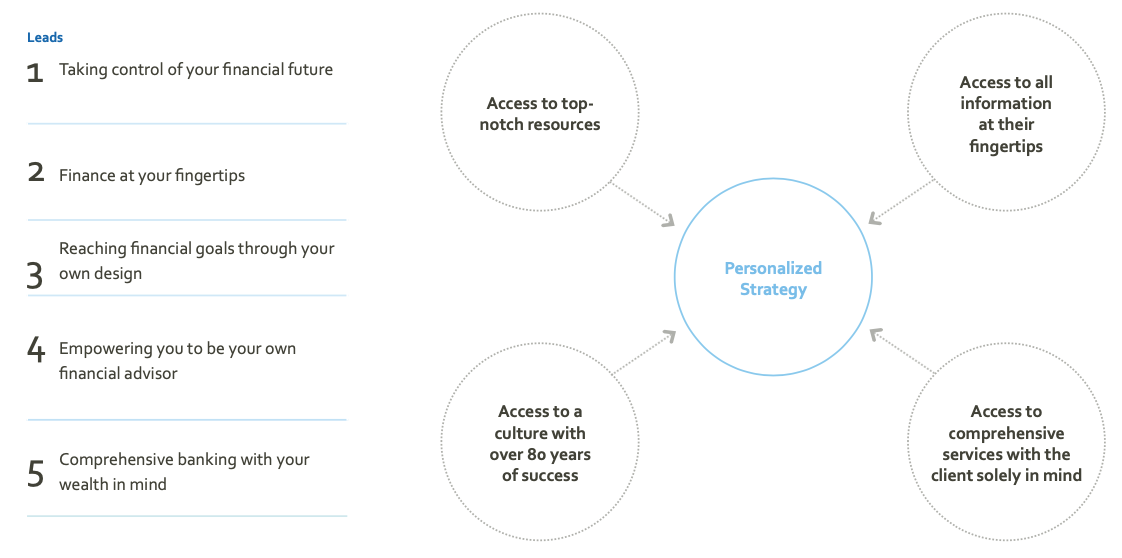

Recommendation

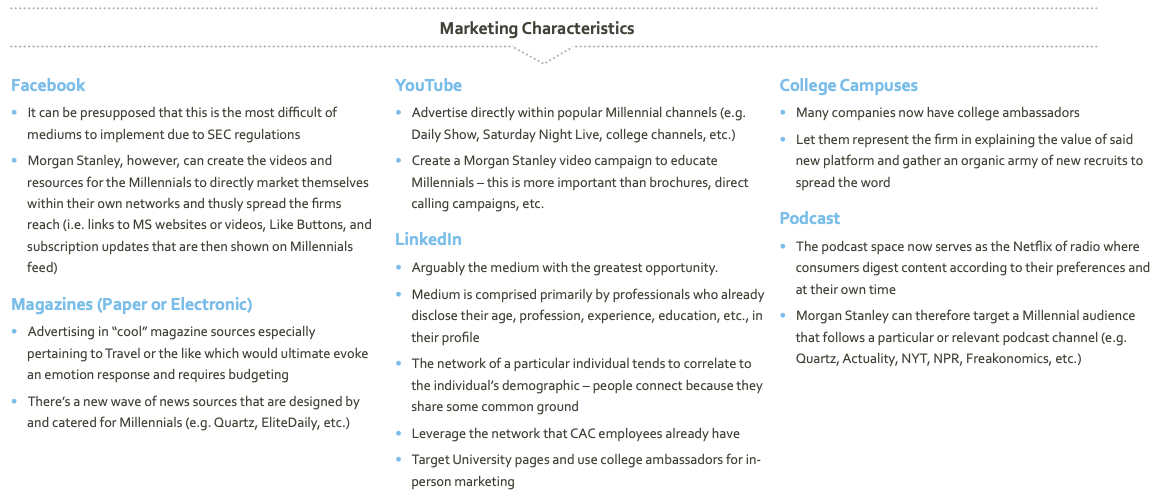

Mediums through which to market:

Purpose of these mediums is to direct traffic to the main website where a video will further illustrate the value, service, and experience of the platform

End-Result

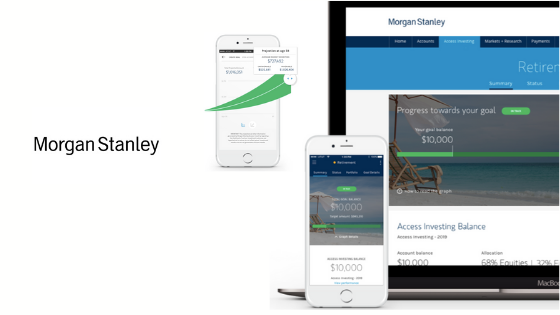

The final product was actually two solutions and ultimately expanded to cater to the mass-affluent (of which a majority are Millennials).

Access Investing

- Goal-based investing

- Reduced Annual Fee

- Investment themes and trends

- Active-Passive strategies

- Morgan Stanley Intellectual Insight

Virtual Advisor

Create a comprehensive plan to help reach your goals with personalized advice from a team of highly skilled Financial Advisors & innovative platforms to help manage your financial life.

- Goal-based investing

- Customized Portfolio

- Collaborative Financial Advisor Team

- Dedicated Support

- Value-driven

- Reduced Annual Fee

Footnotes:

(1) 2014 Independent Community Bankers of America and The Center for Generational Kinetics, LLC.

(2) http://www.newsweek.com/millennials-new-approach-handling-money-308098

(3) http://www.forbes.com/sites/laurashin/2015/05/07/how-millennials-money-habits-could-shake-up-the-financial-services-industry/