Dear Founders,

Congratulations on embarking on your entrepreneurial journey! As a venture capitalist, previous founder, product management leader, and growth strategist, I've witnessed the birth and growth of countless startups over the years. The early stage fundraising process can be laborious and daunting, but it is also a crucial phase that paves the way for your company's success. In this article, I aim to shed light on the history of startup fundraising, the latest trends, best practices, and the different stages of fundraising from your perspective as a founder.

The Evolution of Startup Fundraising:

Throughout history, entrepreneurs have sought external funding to bring their innovative ideas to life. In the early days, entrepreneurs primarily relied on personal savings, family, and friends to fund their ventures. However, with the emergence of modern venture capital in the mid-20th century, the landscape began to change dramatically.

In the 1970s and 1980s, Silicon Valley became a hotbed for startup innovation, and venture capitalists played a pivotal role in providing capital and guidance to entrepreneurs. During this era, iconic firms like Sequoia Capital and Kleiner Perkins made significant investments in companies such as Apple and Genentech, shaping the tech industry as we know it today.

Different Stages of Fundraising from a Founder's Perspective:

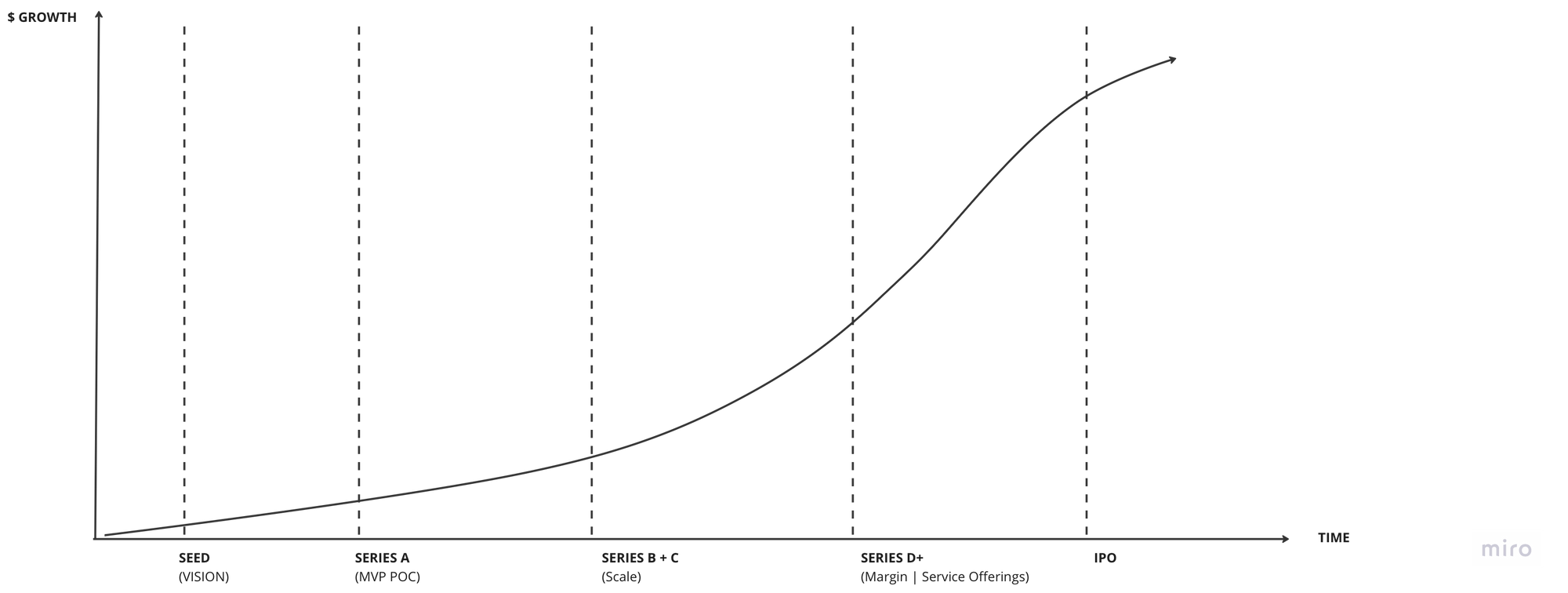

As a founder, it's important to understand the different stages of fundraising and the objectives associated with each stage. While the terminology and specifics may vary, the following stages generally apply to most startup fundraising journeys:

- Pre-Seed Stage:

The pre-seed stage is the earliest phase of fundraising, often characterized by a founder's personal investment, bootstrapping, and support from family and friends. At this stage, your primary objective is to validate your business concept, conduct market research, and build a proof of concept or prototype. Funding may come from your own savings, small grants, or incubator programs. - Seed Stage:

The seed stage is where external investors start showing interest in your startup. Seed funding is typically sought to develop a minimum viable product (MVP), test product-market fit, and launch initial marketing and sales efforts. Angel investors, seed funds, and early-stage venture capitalists are common sources of seed funding. You should focus on building a strong founding team, refining your business model, and demonstrating early traction or user engagement. - Series A Stage:

The Series A stage is a significant milestone that typically follows the successful launch of your product or service. At this stage, you should have a validated business model, early revenue or user growth, and a clear plan for scaling your operations. Series A funding is usually led by venture capital firms, with the aim of fueling rapid growth, expanding your team, and capturing a larger market share. The due diligence process becomes more rigorous, and investors will closely evaluate your metrics, market opportunity, and competitive landscape. - Series B and Beyond:

As your startup continues to grow and mature, you may progress to subsequent funding rounds, such as Series B, Series C, and beyond. These rounds focus on scaling operations, expanding into new markets, and further solidifying your competitive position. With each funding round, the expectations from investors increase, and they will assess your ability to execute your growth strategy, maintain profitability, and deliver returns on their investment.

Best Practices for Effective Fundraising:

To maximize your chances of successfully raising capital at each stage, it's important to follow best practices tailored to the specific requirements and expectations of investors. Here are some key guidelines:

- Research and Target the Right Investors:

Thoroughly research potential investors to find those who align with your industry, stage, and vision. Tailor your pitch accordingly to demonstrate how your startup fits into their investment thesis.

Remember, it's not just about the money; it's about finding the right strategic partners.

- Craft a Compelling Story:

Investors are drawn to compelling narratives that showcase the problem you're solving and the market opportunity. Develop a concise and captivating pitch deck that clearly communicates your value proposition, competitive advantage, and growth potential. Visuals, data, and real-life use cases can enhance your storytelling. - Build a Strong Network:

Networking is crucial in the startup ecosystem. Attend industry events, join relevant communities, and connect with experienced founders and investors. Building relationships early on can lead to valuable introductions and mentorship opportunities. - Nail Your Due Diligence:

Be prepared for the due diligence process, where investors scrutinize your business, team, financials, and legal aspects. Ensure your documentation is organized, transparent, and up-to-date. Proactively address any potential red flags to instill confidence in investors.

Founders, the early stage fundraising journey is undoubtedly a challenging one, but it is also an exhilarating opportunity to transform your vision into reality. By understanding the history, embracing the latest trends, and following best practices, you can navigate this process with confidence and maximize your chances of securing the capital needed to fuel your startup's growth. Remember, each interaction with an investor is an opportunity to learn, refine your pitch, and build relationships that can extend far beyond funding.

Wishing you all the best on your entrepreneurial quest!