Grew sales and advisory team by 350% and added +16,000 industry contacts as subscribers through various marketing campaigns – amassed +150 years of collective experience within 3 verticals (semiconductor, lab, and solar)

About JULO Exchange, Inc.

JULO provides advisory for the procurement and disposition of capital assets in the semiconductor industry

Grew sales and advisory team by 350% and added +16,000 industry contacts as subscribers through various marketing campaigns – amassed +150 years of collective experience within 3 verticals (semiconductor, lab, and solar)

Setting

JULO was a start-up with two advisors at the time. As an asset management platform and service provider in the semiconductor space, we were competing against major institutions like:

Intermediaries

- LSI - Asset Management Platform

- CAET - Broker

- Macquarie - Bank

- FabExchange - Broker

- Global Foundries - End-User

- Surplus Global - Refurbisher

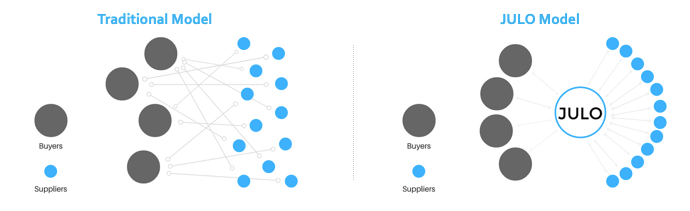

We had fewer resources, less capital, less branding and so we needed to stand out somehow. As part of our DNA, we positioned our efforts around the customer. We tasked ourselves in adding customers (and their underlying assets) into our platform. The goal was very simple: to empower them to make sound decisions in the asset disposition and procurement process and give them the transparency to do so conveniently. That was attractive to many suppliers. We then realized that there was a greater opportunity that we had not realized.

Pain Point

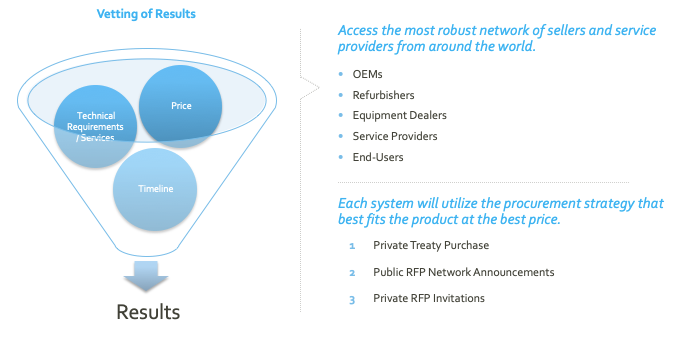

We conducted a research study crossing different verticals and backgrounds over all of our clients (they were eager to share feedback as the needs were present and we were the only company committed and agile enough to adjust):

- Company Vertical (Lab, Semiconductor, Solar, PCB, etc.)

- Company Type (Research Institution, Public Company, Government, etc.)

- Company Size (Rev vs. # of employees)

Our questionnaire focused on not just questions around features, but weights assigned to each. We then averaged and ranked according to the relative strength of the feature.

[Feature X Weight (1-5)] / Total

This allows us to leverage matrices to determine which features would have the most fidelity. Interestingly enough, our hypothesis was correct and we noticed that we were missing some elements critical to offer a holistic disposition and procurement process.

Strategy Mockup

We realized that different platforms were needed to reflect the changing dynamics of scenarios each customer may encounter to dispose of or procure their systems. Our model (see below) already positioned us accordingly. We just needed to build certain platforms

Our model (see below) already positioned us accordingly. We just needed to build certain platforms:

- Private Treaty = execute deals with anonymity between a few parties for shadow transactions

- Auction = the assurance and bulk selling of assets within a time-frame

- Automated Exchange = control time and pricing of assets for the greatest value

- Donation Integration = mitigate tax exposure while serving a good cause and letting go of idle assets

End Result

We built the platform and integrated them into a simple and phased solution for our consultants to advise and execute for our clients.

- Grew sales and advisory team by 350% and added +16,000 industry contacts as subscribers through various marketing campaigns – amassed +150 years of collective experience within 3 verticals (semiconductor, lab, and solar)

- Designed and implemented uniformed sales processes and deal pipelines to enhance quality of service – 92% of clients confirm they plan to work with the firm again

- Managed Tier 1 level enterprise accounts in semiconductor, lab, and solar industries (e.g. GlobalFoundries, Micron, Energy Focus)