Throughout the ever-evolving landscape of innovation, as new giants emerge, the inevitable decline of older giants is witnessed. In my decade-plus journey as a founder and product leader, and now as a VC, I've come to realize that a crucial part of investing is understanding how fledgling startups will stack up against existing industry leaders.

Drawing from my experiences, here are a few insights for those in the start-up ecosystem on how to approach competition when eyeing fresh opportunities.

Why “What’s stopping [insert big tech name here] from doing this?” might not be the right question.

Such questions, though seemingly pertinent, can often be misleading. Take, for instance, the rise of buy-now-pay-later platforms like Affirm or Klarna. If we time-travel to 2007 and you were contemplating an investment in Klarna's Seed round, you might have thought, “Why wouldn’t Amazon jump into this space?” Given Amazon's trajectory in consumer e-commerce, it's a valid speculation.

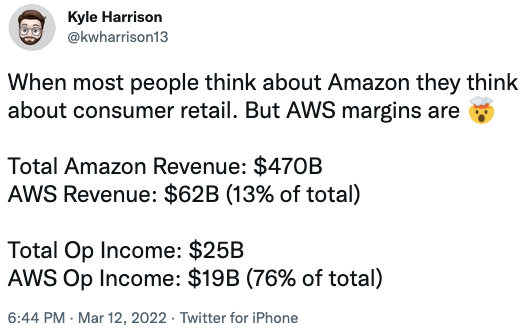

But Amazon had a different ace up its sleeve. Around the same time, Amazon Web Services (AWS) was unveiled. As we now know, AWS not only became Amazon's high-profit business arm but also reshaped the 21st-century technological scene. The story underscores a key point: tech giants like Amazon, Apple, or Google, thrive not by chasing every opportunity but by zeroing in on game-changing markets, much like cloud computing for AWS.

More often than not, startups begin by serving niche markets before they expand. And, if a giant like Amazon or Google ever takes notice, it might just be the golden ticket for a startup acquisition.

Focus on the problem, not just the solution.

When evaluating startups, delve deeper into the problems they aim to solve rather than getting enamored by the product. A classic case is the Dropbox vs. Box narrative. A surface-level look might have you believe they're identical, but a deeper dive reveals that while Dropbox catered to consumers, Box targeted businesses. It’s vital to understand the nuances.

Deciphering the startup scoreboard.

When you frequently review startup pitch decks, you'll often encounter a graphic similar to the one below.

Startups often showcase competitive matrices in their pitch decks. Yet, it's intriguing to note that if you were to compare decks from different competitors, their feature listings would diverge significantly. To make sense of it:

- Understand their target audience. A platform for SMBs can vary vastly depending on its focus: be it dentists or delis.

- Identify what's paramount for these customers. Engage in customer reference calls to uncover the factors driving their buying decisions.

Wrapping it up...

While there's no dearth of strategies to scrutinize market competition, it's paramount to remember that startups thrive not by overshadowing competitors but by resonating with customers.

Reflecting on Jeff Bezos's words, obsessing over customers is the most viable strategy to maintain a company's zeal and vitality.

With years in the trenches of building and scaling products, and now in the pursuit of nurturing the next big disruptors, my aim is to assist, guide, and invest in visions that prioritize customers above all.