Greetings from one entrepreneur to another! As I reminisce about my days as a founder, followed by my time as a product manager at frog, I recognize the profound impact certain insights had on business strategy. Today, I want to share with you an essential metric that, when understood, can significantly amplify your growth trajectory: the Customer Acquisition Cost Double (CACD).

What is Customer Acquisition Cost Double (CACD)?

The CACD metric offers a unique perspective on customer value. While traditional CAC measures the cost of acquiring a new customer, CACD signals the point at which a customer's monthly recurring revenue (MRR) has effectively funded the acquisition of a subsequent customer. In essence, it's when one customer's value doesn't just cover its own acquisition cost but also pays for another customer, thereby creating a self-sustaining cycle of growth.

Example: If it costs your startup $100 to acquire a customer and that customer's average MRR is $50, then the CACD is reached in the second month, when the total MRR contribution of that customer ($100) matches the cost of acquiring a subsequent customer.

Why is CACD Vital for Investors?

As an investor, we constantly look for signs of scalable, self-sustaining growth. CACD represents an organic growth flywheel – it's an indicator that the company isn't just growing but is growing in a way where each customer acquisition fuels the next. This not only reduces dependency on external funding for customer acquisition but also showcases a solid business model.

The DNA of CACD for Founders

Understanding CACD propels founders to focus not just on acquiring customers, but on maximizing their lifetime value. It pushes you to not just attract users but to create evangelists who, through their value, help bring in the next wave of customers.

Example: A streaming platform might have a CACD that's attained within 4 months. Recognizing this, the platform can introduce referral benefits or exclusive content in the fifth month, converting existing subscribers into promoters, which further fuels growth.

Calculating CACD

The moment of CACD realization is when:

Customer’s Cumulative MRR= 2 × CAC

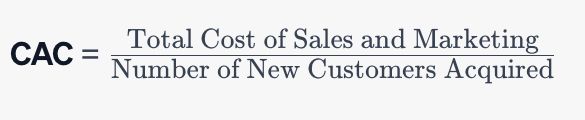

Here:

Example: With a CAC of $100 and an average MRR of $40, CACD is realized in the third month when the customer's cumulative MRR ($120) doubles the CAC.

To further augment your understanding, I'd like to delve into a crucial sub-component: the CACD ratios, particularly CACD to LTV (Lifetime Value), and how they can guide you in making strategic adjustments to your business.

CACD Ratios: Beyond Just Numbers

While CACD helps in understanding when a customer's value covers the acquisition cost of the subsequent customer, the ratio of CACD to LTV provides a richer insight into the business's capital and growth efficiency. Simply put, how effectively is your capital being used to generate long-term customer value?

What does the CACD to LTV ratio signify?

A ratio close to 1 indicates that your business is spending nearly as much on customer acquisition (and the subsequent one) as the total value derived from the customer.

A ratio significantly below 1 is a sign of efficient capital use, whereas a number above 1 could be a red flag, suggesting you're over-spending.

Example: If your CACD is $200 and LTV is $800, then the CACD to LTV ratio is 0.25. This means you are spending 25% of the total value derived from a customer to acquire two customers, highlighting commendable efficiency.

The Power of Knowing your CACD to LTV Ratio

Understanding this ratio empowers founders to:

- Determine Scaling Speed: If the ratio is low, it's an indicator that the business can afford to scale aggressively. Conversely, a higher ratio suggests the need for optimizing operations before pursuing aggressive growth.

- Optimize Marketing Spend: Are your marketing campaigns resulting in high-quality leads with higher LTV or just driving numbers without significant value? This ratio can guide you.

- Adjust Product Pricing: If the ratio is skewed, maybe it's time to reconsider your pricing model. Can you introduce premium tiers or additional services to elevate the LTV?

Example: An e-commerce platform noticing a rising CACD to LTV ratio might identify free shipping as a significant cost. To optimize, they could introduce a subscription-based model offering free shipping, simultaneously elevating the LTV.

Making Business Adjustments with CACD Ratios

- Re-evaluate Channels: If your CACD is too high relative to LTV, consider revisiting your marketing channels. Maybe influencer partnerships yield a lower CACD compared to paid ads.

- Customer Retention: Focus on post-sale services, loyalty programs, or community engagement to enhance LTV, thereby improving the ratio.

- Product Enhancements: Sometimes, the key to elevating LTV is to introduce new features or product extensions based on customer feedback.

Example: A SaaS startup might find that customers drop off after 6 months. By digging deeper, they discover a need for advanced analytics features. Introducing this not only can increase the monthly subscription fee but also extend the average customer lifespan, boosting LTV.

In wrapping up, the magic lies in the details. CACD and its associated ratios aren't mere numbers but strategic guides. They're the compass directing you where to invest, what to adjust, and how to scale. As you sail the choppy startup waters, let these metrics guide your ship to the promised lands of scalable, efficient growth.

CACD isn't just a metric; it's a philosophy. Embracing it means you're aiming for exponential growth where customers play a central role not just in revenues but in fueling further expansion. Adopt this mindset, and you're not just growing; you're making every customer count twice.

Resources:

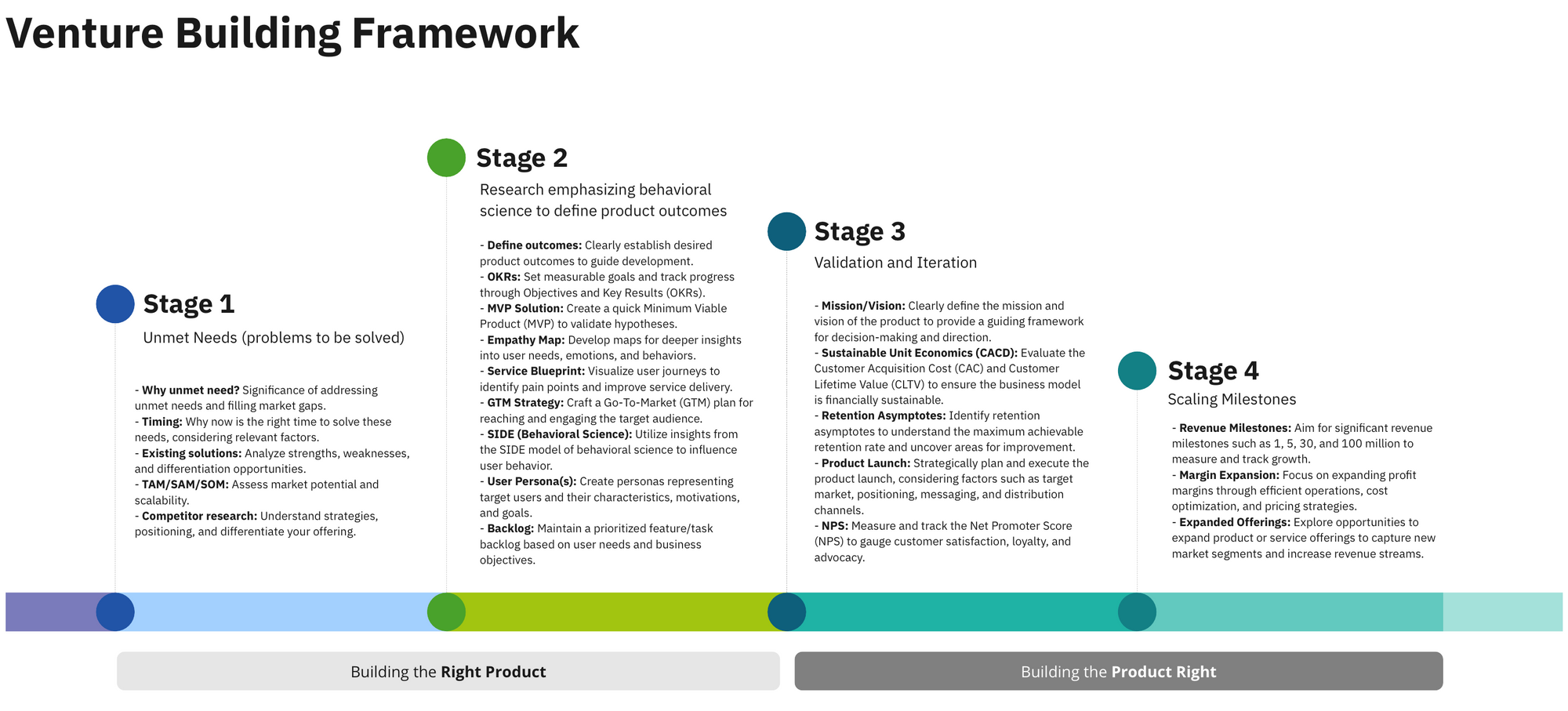

This artifact is part of Stage 3 of the Venture Buildinag Framework.

This is a powerful output as you work to ensure you are Building the Product Right.